Credit Sesame discusses consumer spending resilience in 2022 and how it was financed by increased debt.

Several recent economic reports indicate that consumer spending has remained surprisingly resilient. That may sound encouraging, but a closer look at debt trends shows another side to the story.

The Federal Reserve Bank of New York’s Household Debt and Credit Report for the 4th quarter of 2022 shows that consumer spending is driven by rising debt. That may not be sustainable.

Debt is growing even as rising interest rates make it more expensive. A growing percentage of borrowers who could not keep up with their payments last year suggests the strain is starting to show.

Debt burdens soared in 2022

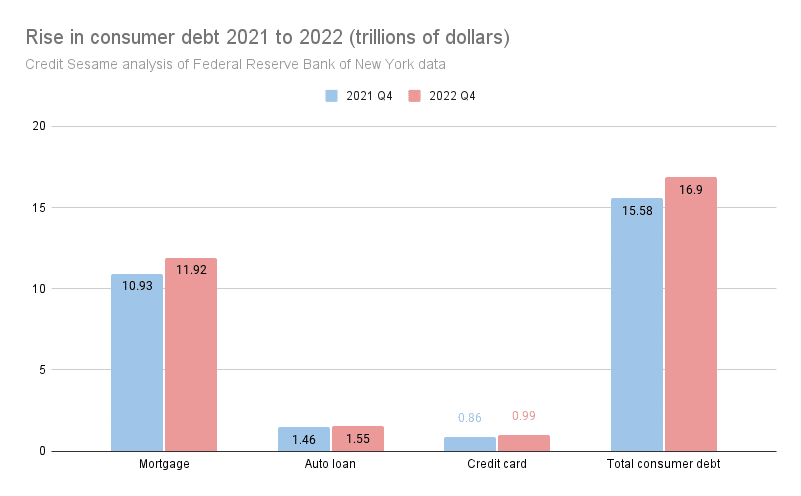

Total consumer debt rose last year reaching a record high of $16.9 trillion. Consumer debt has risen for ten years with a new record high yearly since 2017. However, even by these standards, 2022 was a banner year. Overall consumer debt rose 8.49% last year, the biggest percentage increase since 2007.

Several categories of debt contributed to last year’s increase. The chart shows a comparison between debt balances at the end of 2021 and the end of 2022:

Besides the categories shown on this chart, home equity, student loan and miscellaneous other debts were all up in 2022.

Inflation may have created a need for some of this borrowing. However, the fact that spending has increased faster than the rate of inflation suggests that many consumers are also taking on debt voluntarily.

Rising interest rates are making it harder to carry debt

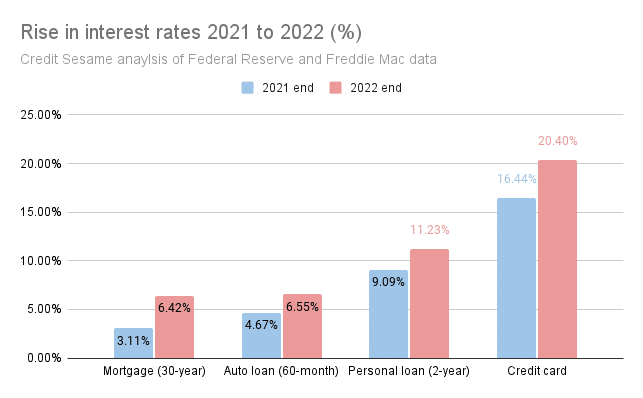

This is an especially bad time to be taking on debt. Fast-rising interest rates make debt much more expensive.

The chart shows how interest rates on several popular forms of consumer credit changed in 2022. The figures come from the Federal Reserve and Freddie Mac.

Rates rose significantly last year. That means any new debt is more expensive than consumers are accustomed to.

For people used to relying on debt to support their lifestyles, this jump in interest rates compounds the effect of inflation.

Delinquency rates show the strain on consumers

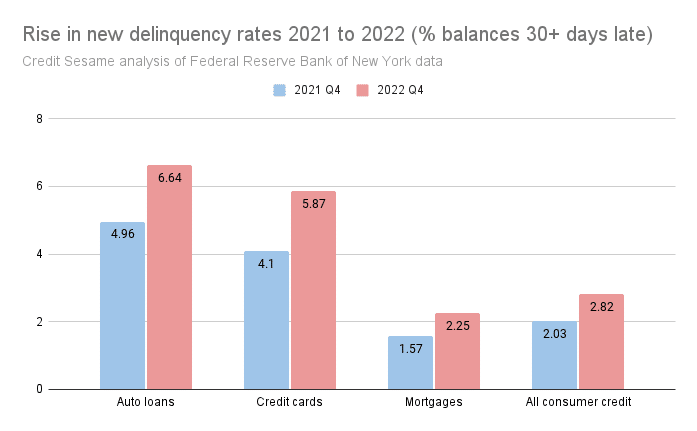

The combination of higher debt burdens and rising interest rates put a strain on borrowers last year. The next chart shows the rise in the percentage of credit balances that became 30 days or more delinquent:

People fell further behind on their debt last year. From a historical perspective, none of these delinquency rates are especially high. However, they are all moving in the wrong direction.

Entering 2023, people are saddled with larger debt burdens and higher interest rates. They now face bigger debt payments. That could cause an already-negative delinquency trend to worsen.

Young adults get a harsh introduction to credit use

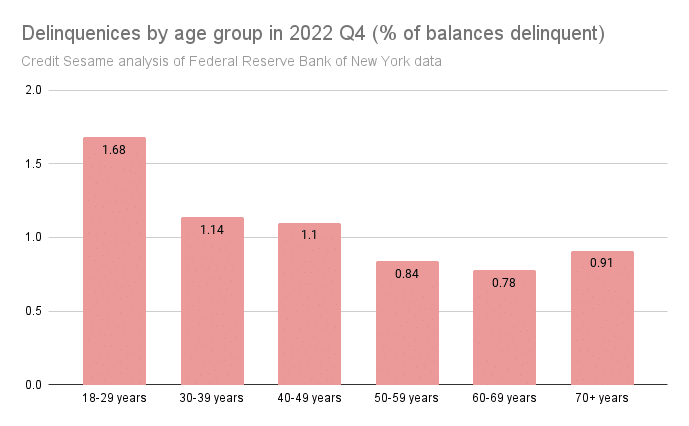

Young adults have an especially hard time keeping up with their payments. The chart below shows the percentage of credit balances becoming late by 30 days or more in the fourth quarter of 2022, broken down by age group:

Adults aged 18-29 have the highest proportion of overdue debt. This is nothing new. Since the beginning of the year 2000, the average new delinquency rate among 18 to 29 year olds has been more than a full percentage higher than for any other age group.

Notably, the two youngest age groups had the biggest increases in new delinquency rates last year. This happened despite a continuing suspension of student loan payments. When those payments are resumed, keeping up with other forms of debt may prove challenging for young borrowers.

The mix of debt is becoming more toxic

Another trend on the latest Household Debt and Credit Report is that credit card debt is growing especially fast. Last year, the total amount owed on credit cards rose by 15.19%, compared with 8.49% for overall consumer debt.

This means that credit card debt is becoming a bigger proportion of people’s debt burdens. This may be a problem because credit card debt can be especially hard to manage for three reasons:

- Generally, it has a higher interest rate than other major forms of consumer debt.

- Money borrowed for new purchases is quickly subject to any change in interest rates because the debt revolves continually. This means rising rates have a greater impact on credit card debt than most loan debt, which locks in a rate for the length of the loan.

- Credit card debt has no predefined repayment period. This means many credit card customers carry high-interest credit card balances year after year.

In short, consumers are not only taking on more debt but they are taking on more of the most expensive debt likely to expose them to rising interest rates.

‘Resilient’ consumer spending may not be such a good thing

In 2022, consumers increased spending by 2.8% more than the inflation rate, according to the Bureau of Economic Analysis. Since consumer spending makes up roughly two-thirds of U.S. economic activity, this was a major factor in the continued growth of GDP last year.

Even with a sharp increase in the cost of living and a looming threat of recession, consumer spending remained resilient last year. That certainly helped the economy in 2022. However, given the extent to which spending was based on increasing debt, the question remains whether it will be sustainable in 2023.

If you enjoyed Consumer spending resilience financed by debt you may be interested in,

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.