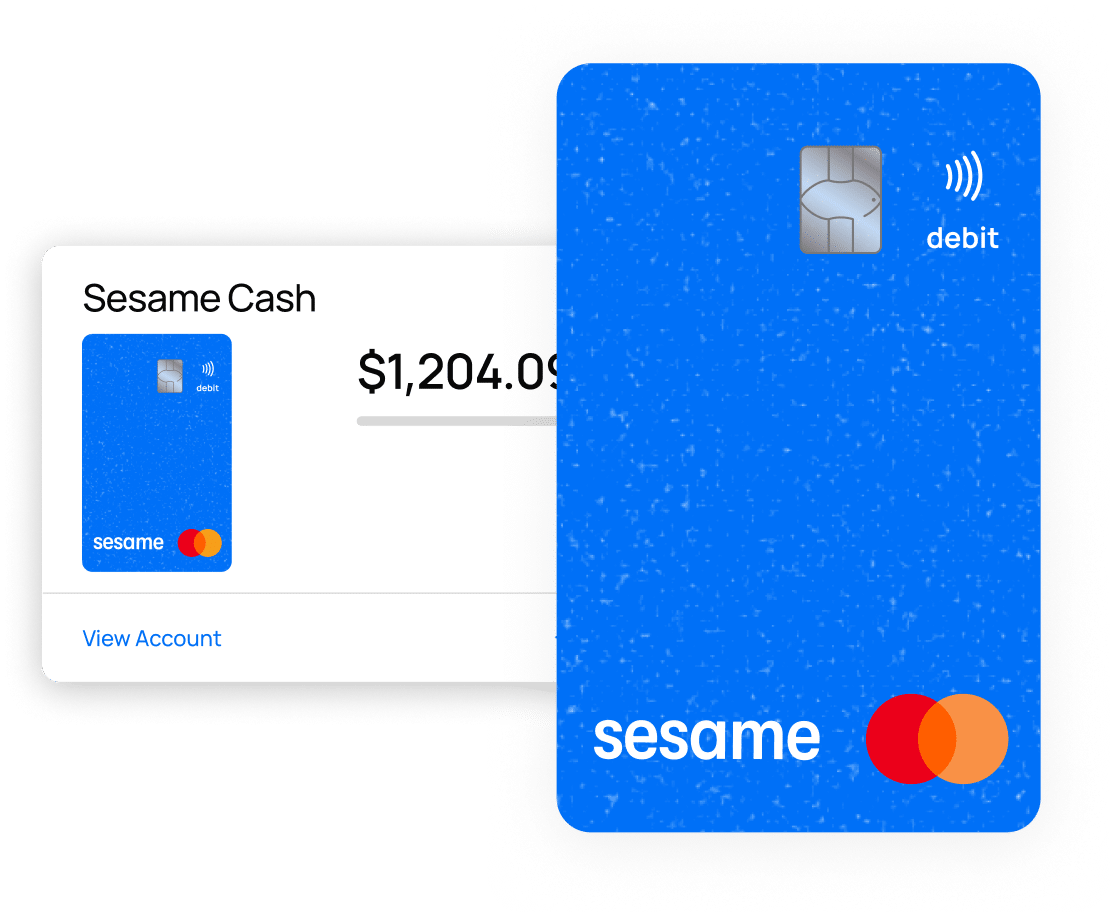

- Sesame Cash

- Account Features

Sesame Cash

Account Features

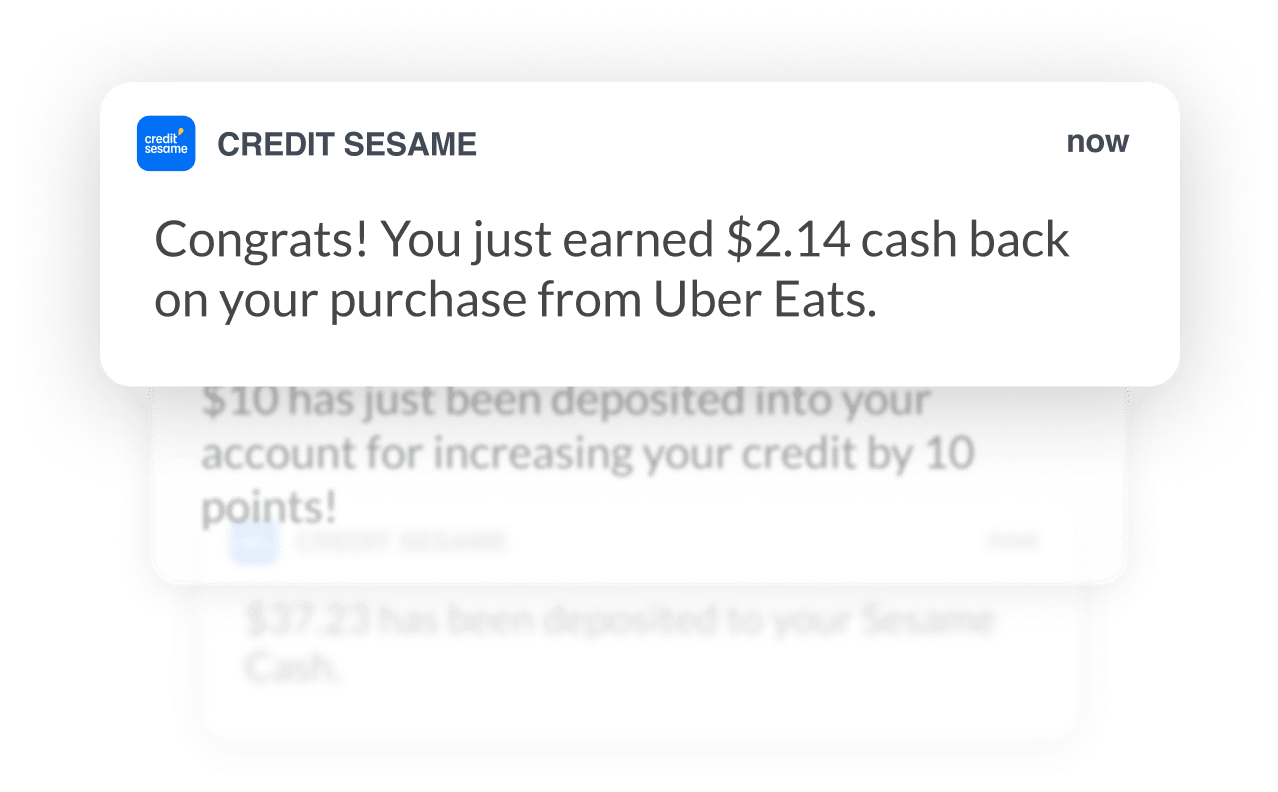

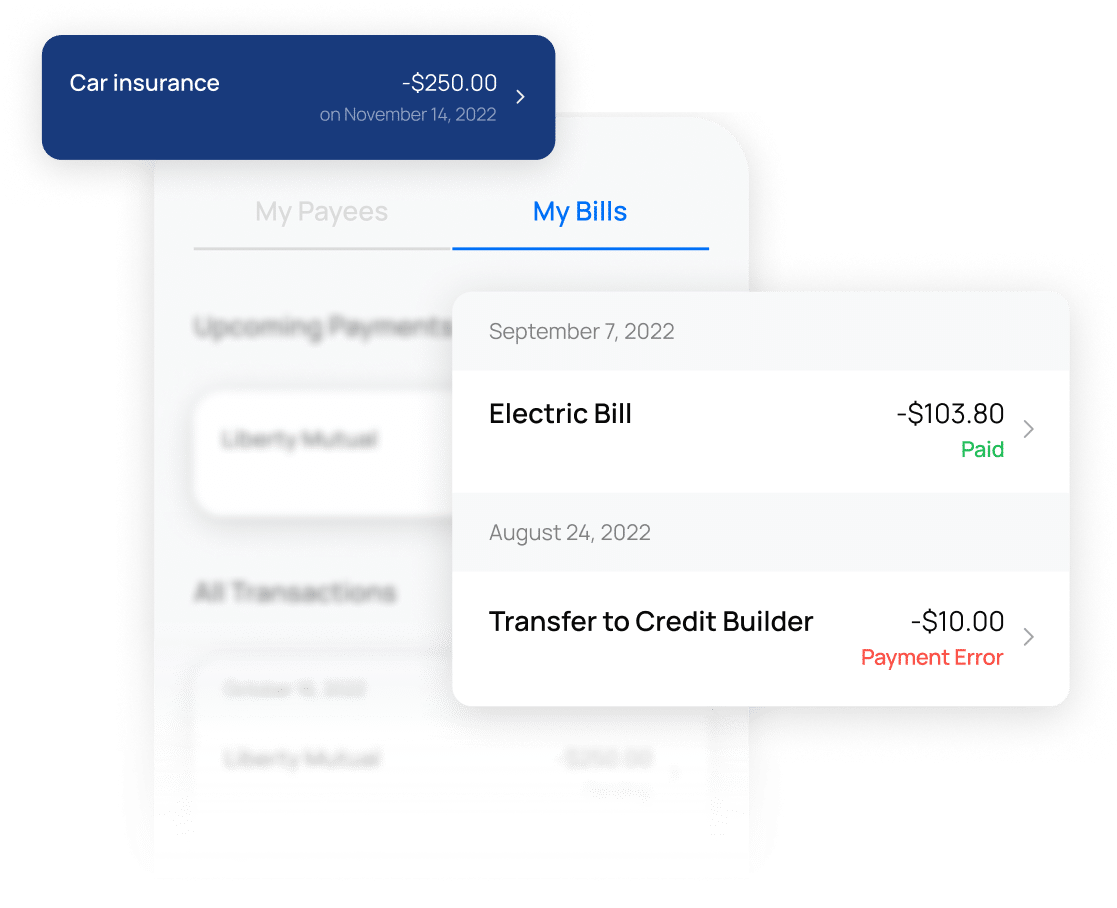

A pre-paid debit card with smarter features. Earn cash back,¹ get direct deposits up to 2 days early,² and build credit history with debit purchases.³ Fees may apply.4

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.