Your FICO Scores are based on the data found in your credit reports from the 3 major credit bureaus, Experian, Equifax, and TransUnion. Lenders use this score to quickly determine whether or not to lend money to you — but do you really know what these scores mean?

This article will shed some light on what credit scores are, and what the three main companies are.

What are your 3 FICO scores and why do they matter?

Your credit score is a 3-digit score, ranging from 300 to 850, that has a direct influence on what credit is available to you, as well as the various terms that your lenders may offer. In other words, it’s a crucial part of your overall credit health.

When you apply for any type of credit, such as a credit card or an auto loan, lenders will obviously want to know what kind of risk they’d be assuming by loaning you the money. To help determine this, lenders will order a copy of your credit report – and, when they do this, they often also buy a credit score that’s based on the information contained in your credit report.

Rather than studying every entry in your credit report, this credit score acts as a quick snapshot that summarizes your credit risk, giving an accurate depiction of what’s in your credit report at any given point in time.

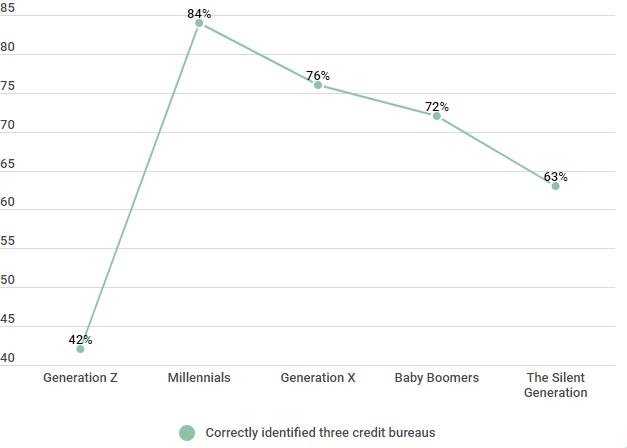

This may not be news to you — in fact, most people know what a credit score is and how it is used. But did you know that you also have more than one credit score and that there are three major credit bureaus? If you didn’t, you’re not alone. Take a look below:

Percentage of Americans Who Understand Credit Scores

| Age Group | Correctly identified three credit bureaus |

|---|---|

| Generation Z | 42% |

| Millennials | 84% |

| Generation X | 76% |

| Baby Boomers | 72% |

| The Silent Generation | 63% |

Source: Credit Sesame quizzed 600 Members with a multiple choice test. The results illustrate which participants correctly answered the entire poll. Incorrect answers often included partially correct results. The survey was conducted April 2015 for two weeks.

As you can see, while the majority of consumers in the Millennial generation and older were able to correctly identify the three major credit bureaus, less than half of Gen Zers were able to do the same. But why does this matter?

Why are your 3 credit scores important?

The most widely identified and used credit scoring model is the FICO Score; therefore, for the purpose of this article, this is what we will primarily focus on. Each of the three major credit bureaus (Equifax, Experian, and TransUnion) have their own methodology for calculating your FICO Score. While it’s important to know this to stay on top of your financial health, there are also some practical “real world” benefits to understanding the differences in your credit scores.

Consider this — each bureau has their own way of collecting information, as well as what they do with that information once it reaches your credit report. You can ask potential lenders which of the credit bureaus they will use to pull your credit report. If one credit bureau reports your FICO Score higher than the others, you could choose to work with lenders that use that particular bureau. This will not only lead to better terms for any loan you may be offered, it will also save you money on interest charges.

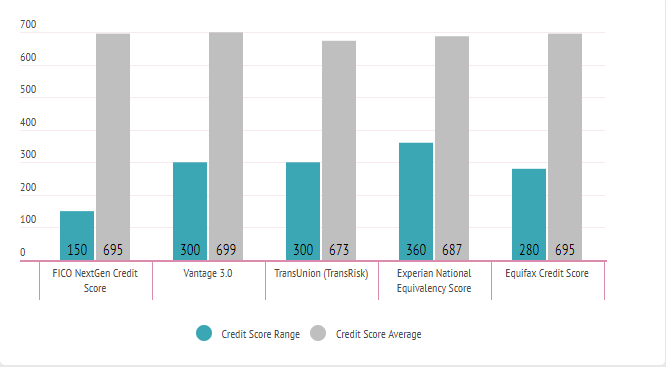

Here we’ve taken a look at various credit score types, as well as their respective score ranges and average scores:

National Credit Score Range and Average Score by Credit Score Provider

| Credit Score Type | Credit Score Range | Credit Score Average |

|---|---|---|

| FICO NextGen Credit Score | 150 - 950 | 695 |

| Vantage 3.0 | 300 - 850 | 699 |

| TransUnion (TransRisk) | 300 - 850 | 673 |

| Experian National Equivalency Score | 360 - 840 | 687 |

| Equifax Credit Score | 280 - 850 | 695 |

Source: Based on the VantageScore, FICO score, Equifax, and Experian credit score range model.

As you can see, each credit score type has its own unique range, as well as an average score that varies slightly. Now, let’s take a closer look at the FICO credit score.

What is a FICO credit score?

The most widely used credit scoring model is the FICO Score, or the credit score created by Fair Isaac Corporation. More than 90% of lenders use your FICO score to help in their billions of decisions relating to credit every year. Your FICO score is a 3-digit number, ranging from 300 to 850, that is calculated using the information contained in your consumer credit report. By comparing the information contained in your credit report to patterns from a large number of past credit reports, your FICO Score quickly and accurately estimates your level of future credit risk as a borrower.

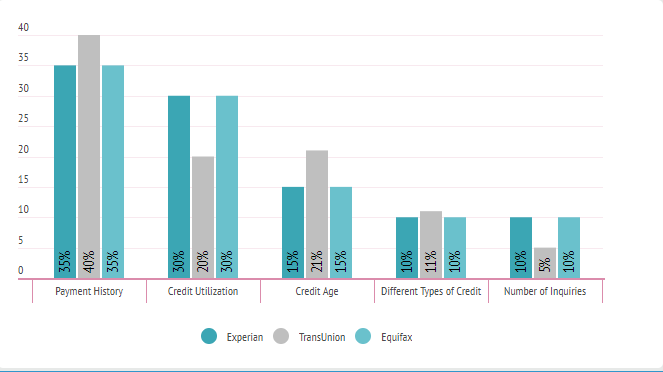

But how is your credit score calculated? Let’s look at the factors that contribute to your credit score, as well as their respective weights for each bureau.

Scoring model calculation (weight) factors by bureau

Description: Credit Sesame wanted to provide the calculation that comprises a credit score by credit bureau.

| Credit Factors, Credit Score Weight | Experian | TransUnion | Equifax |

|---|---|---|---|

| Payment History | 35% | 40% | 35% |

| Credit Utilization | 30% | 20% | 30% |

| Credit Age | 15% | 21% | 15% |

| Different Types of Credit | 10% | 11% | 10% |

| Number of Inquiries | 10% | 5% | 10% |

Source: Data found October 10, 2018. https://www.transunion.com/credit-score, https://money.howstuffworks.com/personal-finance/debt-management/credit-score1.htm

- Payment History. Your payment history is the single largest factor that contributes to your credit score. As such, it is important to make sure you are making your monthly payments on time, every time.

- Credit Utilization. This is another big factor in your credit score. Your credit utilization is the percentage of your total available credit that you are using at any given time. You should aim to always keep this number below 30% — but those with the best credit scores often have a credit utilization below 10%.

- Credit Age. Your credit age, or the length of history, on your credit report also contributes to your credit score (this is where insufficient credit history comes into play). We’ll explore some tips and tricks to help jumpstart this factor, which will help quickly build your credit.

- Different Types of Credit. Lenders also like to see a good mix of credit types. If you only have credit cards, consider adding an auto loan or a credit builder loan. Similarly, if you only have a car loan on your credit profile, consider applying for a secured credit card.

- Number of Inquiries. Lastly, the number of hard inquiries into your credit can also negatively affect your credit score. Checking your credit yourself will never hurt your credit score (in fact, it’s an encouraged practice), but hard inquiries, such as when you are applying for a loan or a credit card can — and will. Limit your applications to only those that are necessary or strategically smart.

What you may notice that is different, however, is the weight each credit bureau assigns to each of these 5 factors. While each bureau looks at the same factors to calculate your credit score Score, they may choose to weigh each factor differently or assign it a different importance. For instance, your payment history contributes to 35% of your total credit score for Experian and Equifax — but this number jumps to 40% for TransUnion. In other words, if you have a stellar payment history, it is likely that your credit score from TransUnion may be higher than your other scores.

What is a good credit score?

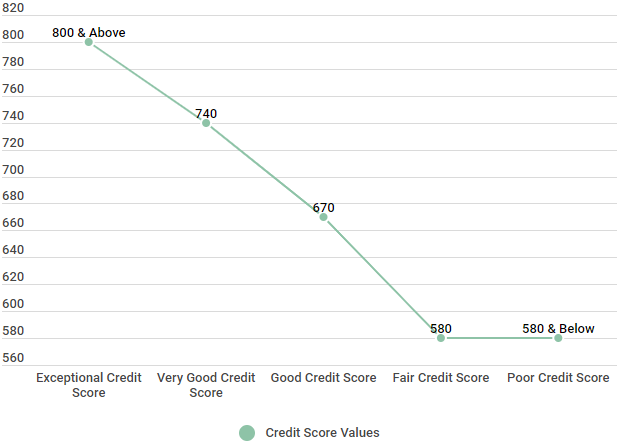

At its core, FICO Scores have a base range of 300 to 850. As you would expect, the higher your FICO Score, the lower your risk as a potential borrower. However, it is important to understand that no single score of any kind can completely say whether a consumer will be a good or a bad customer. Also, while it is true that many lenders will use your FICO Score to help them make credit decisions, each lender has its own unique and individual strategy for determining a threshold of credit score it’s willing to work with. However, there are some generally accepted ranges for FICO Scores.

FICO credit score ranges

Description: Your FICO credit score is classified as one of five categories. Each category represents a numerical range within your credit score and is determined by several factors.

| Credit Score Ranges | Credit Score Values |

|---|---|

| Exceptional Credit Score | 800 & Above |

| Very Good Credit Score | 740 - 799 |

| Good Credit Score | 670 - 739 |

| Fair Credit Score | 580 - 669 |

| Poor Credit Score | 580 & Below |

Source: Fair Isaac Corporation (myFICO.com).

As you can see from the data, any FICO Score above 670 is typically considered to be a “good” credit score. But what are the benefits of having good credit?

What is the benefit of a good credit score?

Having good credit is more than simply a point of pride. Rather, there are a number of practical “real life” benefits to having good credit. Not only does having good credit make it easier for you to buy the things you want and to get approved for loans, it also means better terms and interest rates on those loans.

To think of this another way, we compared the average interest rates of mortgage loans, auto loans, and credit cards for various score ranges. Here’s what we found:

Comparing Credit Score Ranges of Credit Sesame Members

| Score Range | Mortgage Rates | Auto Loan Rates | Credit Card Rates |

|---|---|---|---|

| Bad Credit Score 550 & Below | 6.352% | 15.24% | 22.99% |

| Poor Credit Score 550 to 649 | 5.588% | 14.06% | 18.75% |

| Fair Credit Score 650 to 699 | 5.158% | 7.02% | 16.99% |

| Good Credit Score 700 to 749 | 4.767% | 4.95% | 13.75% |

| Excellent Credit Score 750 & Above | 4.545% | 3.60% | 11.87% |

Source: Credit scores were calculated from 5,000 Credit Sesame members on 3/11/18.

As you can see above, the average interest rate for an auto loan for someone with excellent credit is 3.6 percent. For someone with a bad credit score, this number jumps to more than 15%. While these numbers alone sound startling, let’s take a more practical look at how this breaks down.

Say you want to apply for a $45,000 loan to buy a new car. A 5-year auto loan with a 3.6 percent interest rate means a $821 monthly payment, for a total owed of $49,239 for the loan. If you have bad credit, these numbers are significantly higher. Now, you’re looking at a $1,076 monthly payment, and a total of $64,573 paid for the same loan.

Of course, you should always keep in mind that there really isn’t a single cutoff score used by all lenders, and there may be additional factors that lenders use to determine your actual interest rates. These can include your monthly income, family size, and even where you live

The minimum requirements for calculating a FICO Score

In order for your FICO Score to be calculated, there are some minimum requirements that must be met. In other words, your credit report from the bureau that is calculated your score must contain enough information — and enough recent information — on which to base your score. Usually, this means that you must have at least one account that has been open and active for 6 months or longer, as well as at least one account whose activity has been reported to that credit bureau in the past 6 months.

Your credit score at each credit bureau

You have credit scores at each of the 3 major credit bureaus, and there’s a good chance your score will be slightly different for each. It’s important to regularly check all 3 scores to make sure your credit stays on track.

Your credit score from each credit bureau references only the information contained in your credit report with that particular bureau. If you credit score differs from bureau to bureau, it likely means that each bureau has different information that has been reported on your credit behavior.

With this in mind, we spoke to Credit Sesame member, Jade recently about his credit score and why he checks all 3 of his scores regularly. Here’s what he had to say:

Jade diligently checks all 3 of his credit scores

Member Since: 2/14/2017

| We spoke to Jade on September 25, 2018. He is a 38 year old Navy officer who is based out of Norfolk Virginia. He is married with two kids and he is on a ship 9 months out of the year. | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Why | do | you | regularly | check | your | FICO | score | with | all | 3 | major | credit | bureaus? |

| With me being on the ship so much, I want to make sure that someone isn’t stealing my identity and so I check all three, knowing that some places only report to one or two credit bureaus. | |||||||||||||

| Have | you | found | any | discrepancies? | |||||||||

| Last December I was just about to leave for duty when I checked all three and noticed that one was 30 points lower than the others. I requested my free credit report from that bureau and found out that someone had taken out a loan in my name. Eventually it turns out that someone with my same name took out the loan and they had mistakenly put it under my name. | |||||||||||||

| Why | would | you | recommend | that | someone | regularly | check | all | 3 | of | their | FICO | scores? |

| Even if you are not deploying or leaving home for months at a time, it is a good thing to check your credit score with all 3 bureaus regularly to make sure that everything is right. Don’t be alarmed if they are slightly off, I was originally, but Credit Sesame explained that a small difference is normal. |

Benefits of learning about your 3 credit scores

As we mentioned earlier, there are practical benefits to knowing the difference between your 3 credit scores, as well as checking each of them regularly. Jade’s story is important because it reminds us why we should regularly check each of our 3 credit scores, as well as what to do if something appears to be off. You can use this information to your advantage when working with potential lenders, to secure better loan terms and save yourself money.

TLDR; why you have 3 credit scores and why do they matter?

To quickly recap, your FICO Score is the most widely used credit score, used by more than 90% of major lenders. Each credit bureau has their own formula for calculating your FICO score, and it’s important to stay on top of each of your scores to make sure that your credit health is tracking the way you’d like. Taking control of your credit history is an important first step toward being in control of your financial future — a smart move for anyone.