It’s hard to turn on the news or scroll through social media without seeing a reference to credit or credit scores. Perhaps you even know what your credit score is. But do you know what various credit scores mean? Keep reading to find out all about a 300 credit score.

What is a 300 credit score?

For the purposes of this article, we will focus on your FICO Credit score, since it is the most widely known and most commonly used method for calculating your credit score. Your FICO score is a three-digit score, ranging from 300 to 850 — and the higher the number of your credit score, the better your credit ranking is.

However, your credit score is so much more than just a number. Rather, we would argue that you’ll have a hard time finding a number that more impacts your financial life. Your credit score impacts everything from the interest rate you pay on the purchases on your credit card to whether or not you’re approved for a mortgage to buy a new home.

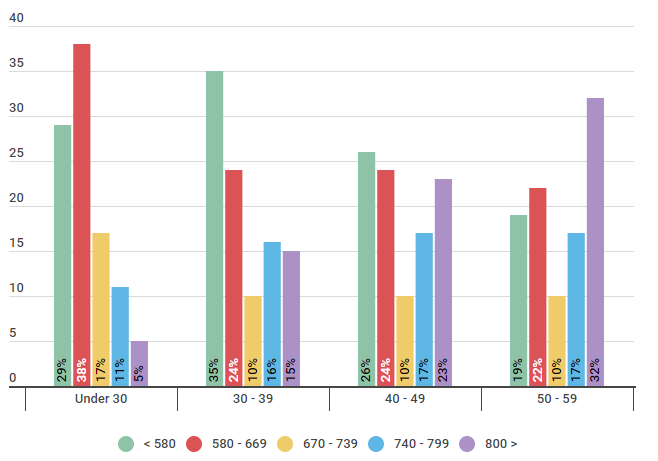

With this in mind, we’ll explore a variety of credit scores, starting with a 300 credit score. Here’s a quick breakdown of where credit scores fall for US adults:

U.S. Population Categorized by the Five FICO Ranges for Credit Scores

| Age | Poor | Fair | Good | Very Good | Excellent |

|---|---|---|---|---|---|

| Gen Z | 29% | 38% | 17% | 11% | 5% |

| Millennial | 35% | 24% | 10% | 16% | 15% |

| Gen X | 26% | 24% | 10% | 17% | 23% |

| Baby Boomers | 19% | 22% | 10% | 17% | 32% |

Source: We ran a survey of 550 US consumers in different age groups on 9/26/2018 to understand which credit score ranges they fell into.

As you can see, a 300 credit score is considered to be in the poor or bad credit range. However, you could have poor credit through no fault of your own. Perhaps you’re just starting out on your credit journey and don’t have an established credit history yet. If you have a 300 credit score, it’s important to know that you’re not alone — and that it’s never too late to improve your credit score.

How to improve your 300 credit score

If you currently have no credit and are trying to quickly improve your 300 credit score, you’re in luck. There are a number of proven strategies to quickly improve your credit score:

- Become an authorized user. Without an established credit history, it is hard to have a good credit score. Consider asking a trusted friend or family member to add you as an authorized user to their account. By being associated with their account, you are essentially borrowing their good credit history — and you will see your credit score quickly improve.

- Apply for a secured credit card. A secured credit card is another great way to build your credit history. A secured credit card is easier to qualify for than a traditional credit card since it requires an up-front deposit. This deposit becomes your credit limit — so, if you default on your payments, the lender can simply take the funds out of your deposit. And, to make the most of your credit score, always make your payments on time.

- Apply for a credit builder loan. Adding a credit builder loan is a great way to not only build your credit history, but to also diversify your credit portfolio. When you take out a credit builder loan, a set amount of money is set aside for you in a special account. You continue to may payments until your loan is paid off — and then you have full access to the account. Again, make sure to always make your payments on time.

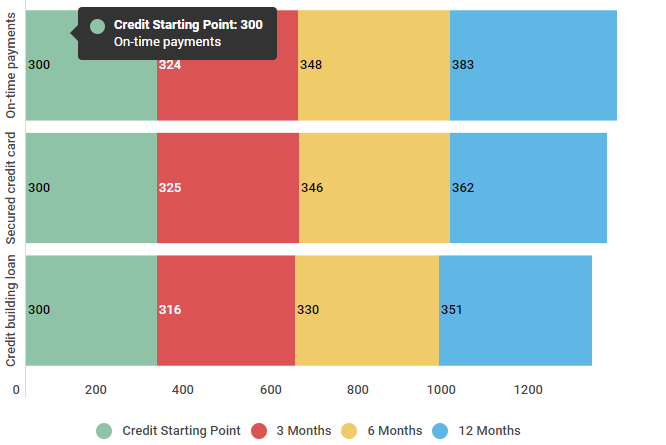

Let’s take a closer look at the average improvement to poor credit scores over the course of 12 months, by using some of these strategies.

Average Credit Score Improvement starting with poor credit

| Method | Credit Starting Point | 3 Months | 6 Months | 12 Months |

|---|---|---|---|---|

| On-time payments | 300 | 324 | 348 | 383 |

| Secured credit card | 300 | 325 | 346 | 362 |

| Credit building loan | 300 | 316 | 330 | 351 |

Source: Review of 600 individuals who for the course of a year who increased their score using various methods. The study was conducted in February of 2016 and concluded April of 2016.

As you can see, each of these strategies works to help quickly improve your credit score — by as much as 83 points over 12 months.

But how is your credit score calculated?

Factors in your credit score

There are many different versions of credit scores, with different scoring models and different types of scores to be found, but almost all of them are based on the following factors:

- Payment history. Your payment history has the single biggest impact on your credit score of all factors. Always make at least the minimum payment, and make all of your payments on time each month.

- Credit utilization. This is simply a fancy term for how much of your available credit you’re currently using. For the best score, you should aim to keep this number at or below 30% (some experts even suggest trying to stay below 10%, although this can sometimes be difficult).

- Length of credit history. The length of your credit history also factors into your score. Always keep your oldest accounts open and in good standing.

- Types of current credit. Creditors and lenders like to see responsible use of a mix of credit types. If you only have credit cards, consider adding a credit builder loan. Similarly, if you only have something like a student loan on your credit report, consider applying for a credit card or store account card.

- Account inquiries. The number of credit inquiries for your account can also impact your score. As we’ve mentioned, soft inquiries (when you check your credit yourself) do not affect your score, but a hard inquiry, such as when you apply for a new credit card, can. Limit the number of your applications for the best score.

Now, let’s take a closer look at just how much each of these factors can impact your score.

FICO scoring model calculation (weight) factors

| Credit Factors | Credit Score Weight |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Credit Age | 15% |

| Different Types of Credit | 10% |

| Number of Inquiries | 10% |

Source: https://www.myfico.com/credit-education/whats-in-your-credit-score.

As you can see, your payment history and credit utilization are the two factors that most impact your credit score, with the age of your credit history coming in 3rd at 15%.

Next, let’s look at what you can expect with a 300 credit score.

What can you expect with a 300 credit score

As we mentioned earlier, the interest rates you pay on various types of loans or lines of credit depend directly on your credit score. With this in mind, let’s take a quick look at the average interest rates for consumers with a 300-549 credit score range.

Interest Rate Ranges for Different Credit Score Ranks

| Type of Loan | 300-549 |

|---|---|

| 30 Year Fixed Mortgage Interest Rate | 6.352% |

| Car Loan Interest Rate | 15.24% |

| Credit Card Interest Rate | 24.9% |

Source: Credit Sesame asked 400 members about their interest rates during a three week period beginning in January 18, 2018.

As you can see, with a credit score below 550, you are unfortunately stuck paying high interest rates, on everything from credit cards to a mortgage loan. For this reason, it’s important to do all that you can to improve or build your credit score.

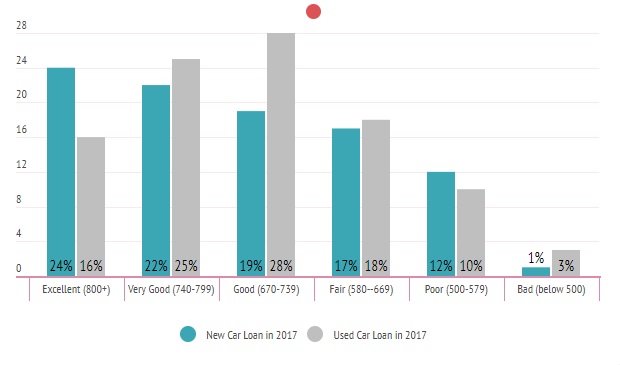

Can you get a car with a 300 credit score?

If you have a 300 credit score and are considering the purchase of a car, you may be wondering if you can qualify for an auto loan with your credit score. To help, we surveyed 600 Credit Sesame members with various credit scores to see how car loans were distributed in 2017. Take a look at what we found below:

Percentage of New & Used Car Loans Distributed Among Credit Rank of Consumers

| Credit Score | New Car Loan in 2017 | Used Car Loan in 2017 |

|---|---|---|

| Excellent (800+) | 24% | 16% |

| Very Good (740-799) | 22% | 25% |

| Good (670-739) | 19% | 28% |

| Fair (580--669) | 17% | 18% |

| Poor (500-579) | 12% | 10% |

| Bad (below 500) | 1% | 3% |

Source: Credit Sesame followed 600 Members in 2017 documenting their choices for automobile financing and purchasing decisions and were divided by FICO Credit Score Ranking. The poll was conducted from January 2017 until December of 2017.

As you can see, only 3 percent of used car loans in 2017 went to those with credit scores below 500 — and that number drops again when looking at new car loans. Fortunately, hope is not lost if you can’t qualify for an auto loan on your own. By adding a cosigner to your loan, you greatly increase your chances of approval.

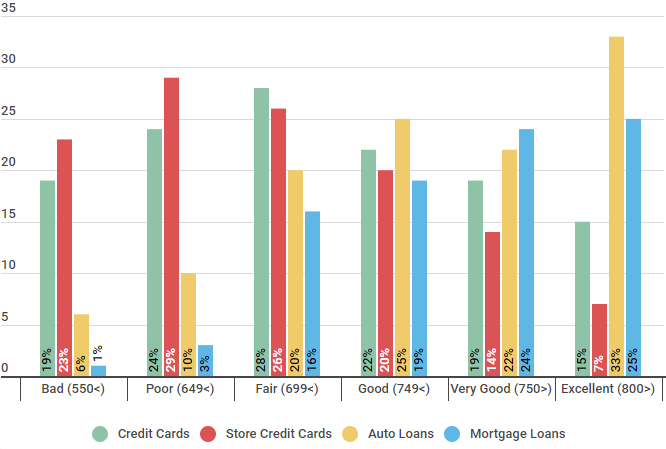

Can you get a credit card with a 300 credit score?

When it comes to credit cards, what are your options with a 300 credit score? We took a look at consumers who were approved for new credit accounts in 2017, broken down by their credit ranking:

Percentage of Credit Sesame Members Who Open New Credit Accounts in 2017

| Credit Ranking | Credit Cards | Store Credit Cards | Auto Loans | Mortgage Loans |

|---|---|---|---|---|

| Bad (550<) | 19% | 23% | 6% | 1% |

| Poor (649<) | 24% | 29% | 10% | 3% |

| Fair (699<) | 28% | 26% | 20% | 16% |

| Good (749<) | 22% | 20% | 25% | 19% |

| Very Good (750>) | 19% | 14% | 22% | 24% |

| Excellent (800>) | 15% | 7% | 33% | 25% |

Source: Review of 1000 Credit Sesame Members during December 2017 until December 2018. 167 participants made up each credit ranking (Bad, Poor, Fair, Good, Very Good, Excellent).

Among those with credit scores below 550, nearly 20 percent were able to secure a credit card — and that number is closer to 25 percent for store credit cards. However, it is important to remember that with this type of credit score, you will most likely have to pay a higher interest rate — so try to pay off your balances each month, if possible.

| Free credit score |

|---|

| Bad credit score |

| How to increase your credit score immediately |

| Credit repair services |

| Bad credit mortgage |

| Perfect credit score |

Dealing with negative information on your credit report

If negative information in your credit report is accurate, there isn’t much you can do about the mark except wait for it to age off of your credit report. But how long do negative marks stay on your credit report? Here’s a quick guide:

- Late payments or past due accounts — 7 years

- Collections — 7 years from original date of delinquency

- Hard inquiries — 2 years

- Bankruptcy — 7 years for Chapter 13, 10 years for Chapter 7

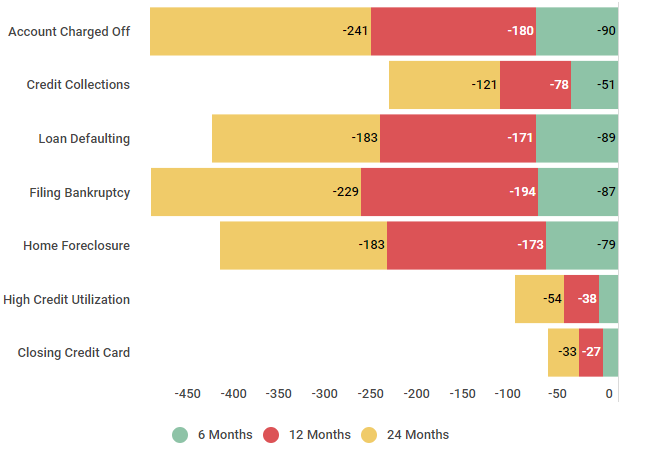

Wondering how negative marks impact your credit score over time? Let’s take a look below:

Negative Impacts on Bad Credit (550<) Ranking over 6, 12, and 24 Months

| Negative factor | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| Account Charged Off | -90 | -180 | -241 |

| Credit Collections | -51 | -78 | -121 |

| Loan Defaulting | -89 | -117 | -142 |

| Filing Bankruptcy | -87 | -194 | -229 |

| Home Foreclosure | -79 | -173 | -183 |

| High Credit Utilization | -21 | -38 | -54 |

| Closing Credit Card | -16 | -27 | -33 |

Source: Credit Surveyed 80 people with a Bad Credit Ranking who reported negative impacts to their credit score over a period of two years between February of 2015 and March of 2017. The numbers represent the average credit score points gained or lost by the stated factors.

As you can see, these negative marks can have a huge impact on your credit score — costing you as many as 241 points over the course of 24 months. As such, it’s important to do all that you can to keep your credit score in top shape.

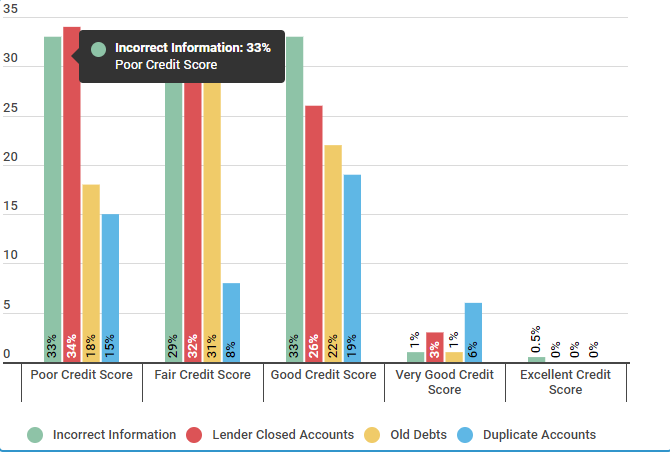

Believe it or not, nearly 40 percent of credit reports can contain errors, so it’s important to regularly check your credit report for any inaccurate or outdated information. If you find any errors on your report, you have the right to dispute the mark and have it removed from your credit report.

But what negative marks make the largest impact on your credit score? Let’s explore below:

Largest Impacts in Inaccurate Credit Reports

| Credit Ranking | Incorrect Information | Lender Closed Accounts | Old Debts | Duplicate Accounts |

|---|---|---|---|---|

| Poor | 33% | 34% | 18% | 15% |

| Fair | 29% | 32% | 31% | 8% |

| Good | 33% | 26% | 22% | 19% |

| Very Good | 1% | 3% | 1% | 6% |

| Excellent | 0.5% | 0% | 0% | 0% |

Source: Credit Sesame surveyed 250 people, 50 had a poor credit ranking, 50 participants had a fair credit score, 50 members had a good credit rating, 50 people were listed as very good, and 50 members reported they had an excellent credit score. The study was conducted on October 20, 2017, over a period of two weeks.

Among those with poor credit scores, the largest impact was caused by lender closed accounts, followed closely by incorrect information.

We spoke with Credit Sesame member, Susan, to find out how she was able to raise her 300 credit score. Here’s what she had to say:

Learn how Susan T. raised her credit score from 300

Member Since: January 16, 2016

We interviewed Susan T. on February 16, 2017. She earns $27,000 a year and is 30 years old. She lives in Melbourne, FL. She’s married and expecting her 2nd child.

Susan’s story is good for all of us to read because it shows the importance of consistency and persistence when trying to improve your credit score.

TLDR; how do you get out from a 300 credit score?

In conclusion, there are a number of reasons that you may have a 300 credit score. The most common reason is a lack of credit history. Fortunately, there are strategies that you can follow to quickly see improvements to your credit score. For more ways to improve your credit score, check out this article.