Wondering what your 720 credit score means? We’ve got you covered. This article reveals everything you need to know about a 720 credit score, including how it’s calculated, how to improve it, what it could get you, and more.

What can you do with a 720 credit score?

While there are a number of different credit scoring models, such as FICO Score and VantageScore, for the purposes of this article, we’ll be discussing the FICO Score, since it is by far the most widely used model. Your FICO Score is a three-digit number that represents your creditworthiness to a potential lender. Scores range from 300 to 850, and the higher your score is, the better credit you have.

| Check your free credit score today in just 2 minutes. |

|---|

| Learn different techniques around building credit and what it can do for you. |

| Credit problems? Learn how to fix your credit in 3 months or less. |

| Try different techniques and learn how to improve your credit score to get better financial rates. |

| What is a bad credit score and why it matter for your financial success. |

| Find out how you can attain a perfect credit score and what it could do for your finances. |

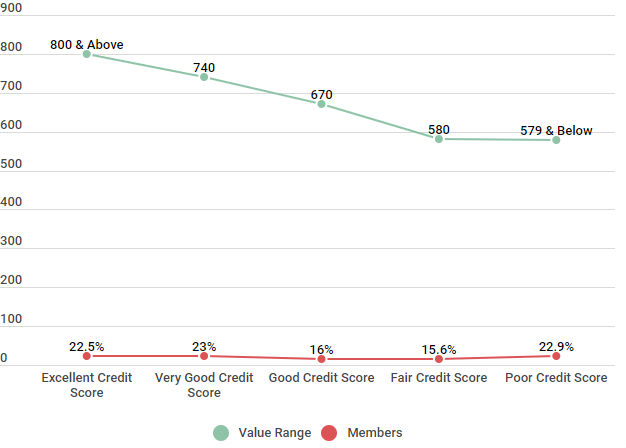

Below, you can see a breakdown of the generally accepted credit score ranges. You’ll notice that a 720 credit score falls in the “Good” range, whereas anything below 700 is considered “Fair” and anything above 750 is considered to be “Very Good.”

Comparing Credit Score Ranges of Credit Sesame Members

| Score Range | Value Range | Members |

|---|---|---|

| Excellent Credit Score | 800 to 850 | 22.5% |

| Very Good Credit Score | 750 to 799 | 23% |

| Good Credit Score | 700 to 749 | 16% |

| Fair Credit Score | 650 to 699 | 15.6% |

| Poor Credit Score | 550 to 649 | 14.9% |

| Bad Credit Score | 549 & Below | 8% |

Source: Credit scores were calculated from 350 Credit Sesame members on 3/6/18.

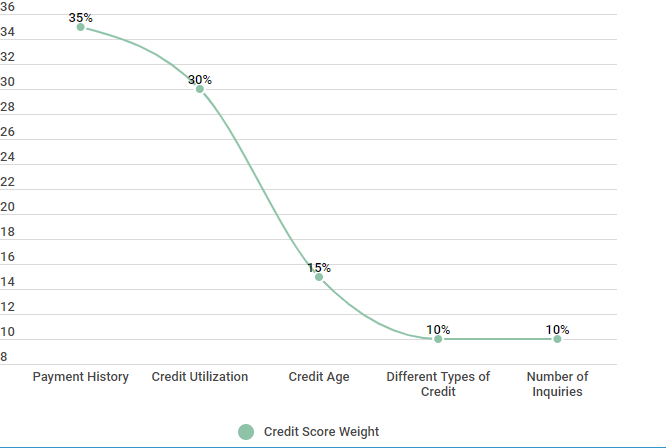

Factors in your credit score

In order to fully understand your credit score, let’s take a closer look at what goes into building your score:

- Payment History. Your payment history is the single biggest factor that contributes to your credit score. This shows potential lenders how often your payment have been on time — or if they have been late or missed.

- Credit Utilization. While this may sound complicated, your credit utilization is simply the percentage of your total available credit that you are currently using. This number is expressed as a percentage and, to keep the best score, you’ll want to keep your number below 30 percent.

- Credit Age. The age or length of your credit history also contributes to your score. To make the most of this factor, make sure to keep your oldest accounts open and in good standing.

- Credit Mix. Potential lenders like to see a mix of different credit types on your report, such as credit card accounts and an auto or mortgage loan.

- Number of Inquiries. While checking your credit score won’t hurt your account, hard inquiries, such as when you apply for a new credit card, will. Limit the number of hard inquiries on your credit to keep your score high.

As you can see below, these are the factors that make up your basic credit score. You’ll also notice that some are weighted more heavily than others. For instance, your payment history factors into your score more than 3 times as much as the number of inquiries you have.

FICO Scoring Model Calculation (Weight) Factors

| Credit Factors | Credit Score Weight |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Credit Age | 15% |

| Different Types of Credit | 10% |

| Number of Inquiries | 10% |

Source: https://www.myfico.com/credit-education/whats-in-your-credit-score

How to maintain or improve your 720 credit score

Even with good credit, there are always steps that you can take to help build and improve your credit. But before you can know how to improve your score, you need to first understand the individual factors that contribute to your score. To help improve your score, you’ll want to focus on the following factors.

Average Credit Score Improvement starting with good credit

| Method | Credit Starting Point | 3 Months | 6 Months | 12 Months |

|---|---|---|---|---|

| Onetime payments | 720 | 723 | 730 | 744 |

| Secure credit card | 720 | 722 | 729 | 740 |

| Credit building loan | 720 | 723 | 730 | 744 |

Source: Review of 600 individuals increased their credit by different methods The study was conducted in February of 2016 and concluded April of 2016.

Now that you know how your score is calculated and some basics on how to improve your score, let’s look at what you can expect to get with a 720 credit score.

What can you expect with a 720 credit score?

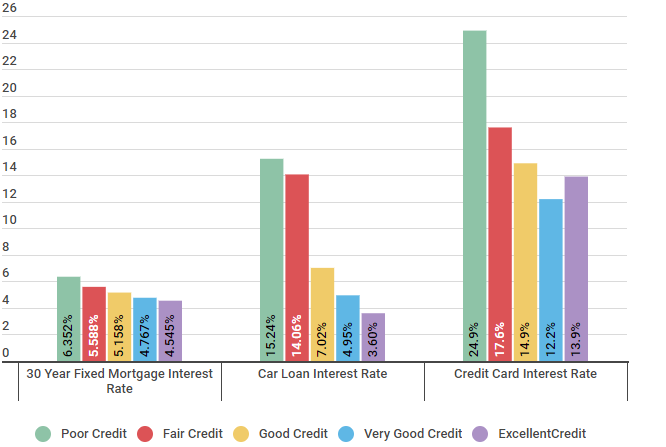

As you can see from the numbers below, having a good credit score not only makes it easier for you to secure credit or a loan when you need it, it will also save you a significant amount of money in the process.

Interest Rate Ranges for Different Credit Score Ranks

| Type of Loan | Poor Credit | Fair Credit | Good Credit | Very Good Credit | Exceptional Credit |

|---|---|---|---|---|---|

| 30 Year Fixed Mortgage Interest Rate | 6.352% | 5.588% | 5.158% | 4.767% | 4.545% |

| Car Loan Interest Rate | 15.24% | 14.06% | 7.02% | 4.95% | 3.60% |

| Credit Card Interest Rate | 24.9% | 17.6% | 14.9% | 12.2% | 13.9% |

Source: Credit Sesame asked 400 members about their interest rates during a three week period beginning in January 18, 2018.

Let’s take a more practical look at what this means.

Let’s say you want to purchase a house with a $150,000 mortgage. With “Good” credit, you could receive an interest rate of 5.158 percent. With a 30-year fixed loan, that translates into monthly payments of roughly $819.78. By the time the 30 years is over, you’ll have paid $145,120.38 in interest. On the flip side, if you have “Poor” credit and receive a rate of 8.2 percent, your monthly payment is roughly $933.55 and you’ll have paid $186,077.84 in Interest by the end of the loan.

As you can see, it’s financially in your best interest to improve your credit, in this situation, more than $40,000 over 30 years. Improving your credit can get the best possible terms for things like mortgages, car loans, and more.

Dealing with negative information on your credit report

With a score of 720, the chances are good that you won’t have too many negative factors on your credit report. It’s no secret that negative information can have a huge impact on your credit score and your credit report — not to mention your ability to get new credit with favorable terms, moving forward. Fortunately, negative marks don’t last forever.

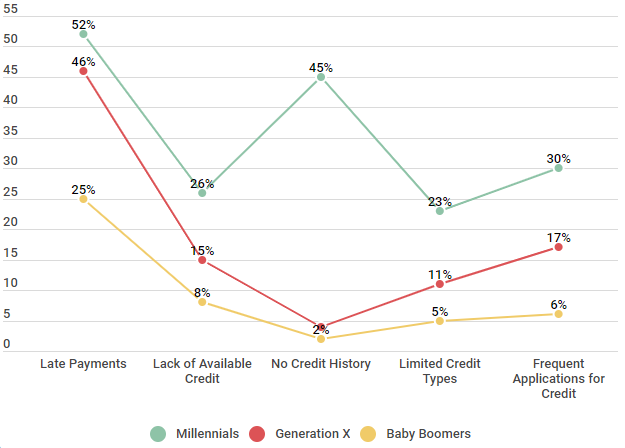

Here are some of the negative factors currently contributing to low credit scores of Credit Sesame members, broken down by generation.

Negative Factors that Contribute to Low Credit Scores

| Negative Factors | Millennials | Generation X | Baby Boomers |

|---|---|---|---|

| Late Payments | 52% | 46% | 25% |

| Lack of Available Credit | 26% | 15% | 8% |

| No Credit History | 45% | 4% | 2% |

| Limited Credit Types | 23% | 11% | 5% |

| Frequent Applications for Credit | 30% | 17% | 6% |

Source: Credit Sesame polled 300 participants between February 10, 2018 and February 17, 2018. 100 participants were Millennials, 100 participants were members of Generation X, and 100 participants were Baby Boomers.

Errors that impact credit scores

The first step to improving your credit is to make sure that all the information on your current credit report is accurate. Get a copy of your credit report from all 3 major credit bureaus, and check it closely for any errors or outdated information. It is estimated that as many as 1 in 5 reports contain inaccurate information that can negatively impact your score.

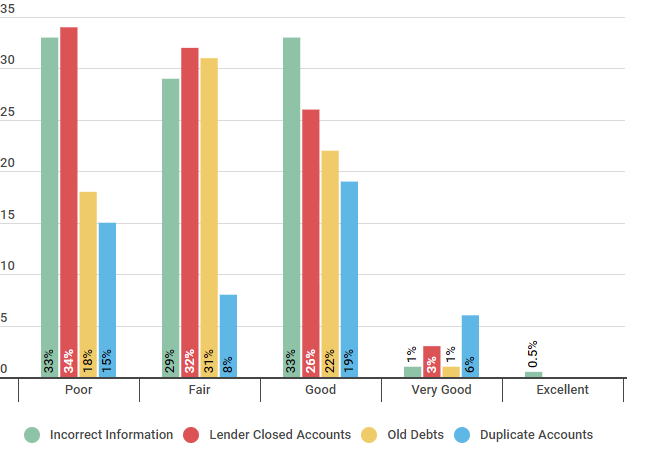

Here is a list of some of the most common errors that can have a negative effect on your credit score. As you can see, someone with poor credit has more errors on their credit report — confirmation that regularly checking your credit report and clearing up any inaccuracies leads to better credit scores.

Errors Which Affect Credit Rankings

| Credit Ranking | Incorrect Information | Lender Closed Accounts | Old Debts | Duplicate Accounts |

|---|---|---|---|---|

| Poor | 33% | 34% | 18% | 15% |

| Fair | 29% | 32% | 31% | 8% |

| Good | 33% | 26% | 22% | 19% |

| Very Good | 1% | 3% | 1% | 6% |

| Excellent | 0.5% | N/A | N/A | N/A |

Source: Credit Sesame surveyed 250 people, 50 had a poor credit ranking, 50 participants had a fair credit score, 50 members had a good credit rating, 50 people were listed as very good, and 50 members reported they had an excellent credit score. The study was conducted October 20, 2017 over a period of two weeks.

Now that you know what impacts your credit score and what you can do to improve your score, let’s take a look at how one Credit Sesame member did just that.

How Nellie improved her 692 credit score to 720 in 3 years

We spoke to Credit Sesame member, Nellie, and asked her how she was able to improve her credit score to 720. Here’s what she had to say:

Member Since: 4-26-2016

| We interviewed Nellie on May 18, 2018; she earns $44,000 a year, is 31 years old and lives in Tampa, Fla. She currently rents an apartment with her boyfriend. | ||

|---|---|---|

| b>What did you do to improve your 720 credit score? | b> | |

| I’ve been observing and improving my credit score for the past three years when it was an all-time low of 692. I have a budget and my credit cards are only used for earmarked purposes. I make sure to stay within the recommended 30 percent utilization of my credit limits and always pay on time. I’ve kept old credit cards open, but I don’t use them very often. | ||

| b>What is your credit score now? | b> | |

| My credit score is 720 now, but doesn’t change very much these days now that I’ve fixed the big factors that were pulling my score down. | ||

| b>How long did it take to improve your 720 score? | b> | |

| It took me three years to increase my score. I really had to adjust my spending habits, which is actually a big lifestyle change. It was hard to do, but I keep reminding myself that it’s worth it. I’m planning to get a new car next year and hope to get a much better auto loan this time around. |

Nellie’s story is a great reminder that improving your credit score really does mean going back to the basics. Make all of your payments on time, keep your credit utilization low, and keep your oldest accounts open. Stay the course, and you’ll see the benefits in the long run.

TLDR; why the 720 credit score matters

To sum it up, a 720 credit score is considered to be a “Good” score. You should have no trouble getting approved for a loan or a credit card — and should expect favorable terms on both. If you want to improve your score, focus on the factors that impact your credit score and start there. Time, along with good credit habits, can improve almost any score.